Bitcoin Collateralized Loans

One of the most exciting applications of BeL2 is the ability to use Bitcoin as collateral for loans without moving it off the main Bitcoin network.

Overview of the Loan Demo

BeL2's peer 2 peer loan demo showcases a real estate mortgage-like model for Bitcoin-backed loans:

Key Features:

- Use Bitcoin as collateral to borrow stablecoins (e.g., USDC)

- Fixed interest rates determined by the market

- Repayment on maturity with no liquidation before the due date

- If borrowers default, lenders receive additional Bitcoin

How to Use the lending.bel2.org Platform

-

Visit https://lending.bel2.org

-

Connect your wallet (supports various Bitcoin and EVM-compatible wallets)

-

Lender's perspective:

- As a lender, you deposits USDT on the EVM.

-

Borrower's perspective:

- As a borrower, you prepare to lock the corresponding amount of BTC to acquire the USDT

- Choose the loan terms (duration, ...)

- Confirm the transaction to lock your Bitcoin

- Receive the borrowed stablecoins in your connected wallet

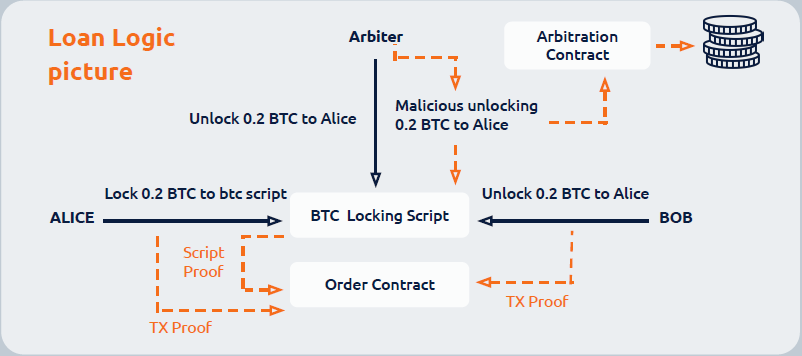

Diagrams

Logics

Borrowing flow

Repayment flow

Why it's revolutionary

This system allows Bitcoin holders to access liquidity without selling their BTC or trusting centralized platforms. It combines the security of Bitcoin with the flexibility of DeFi.